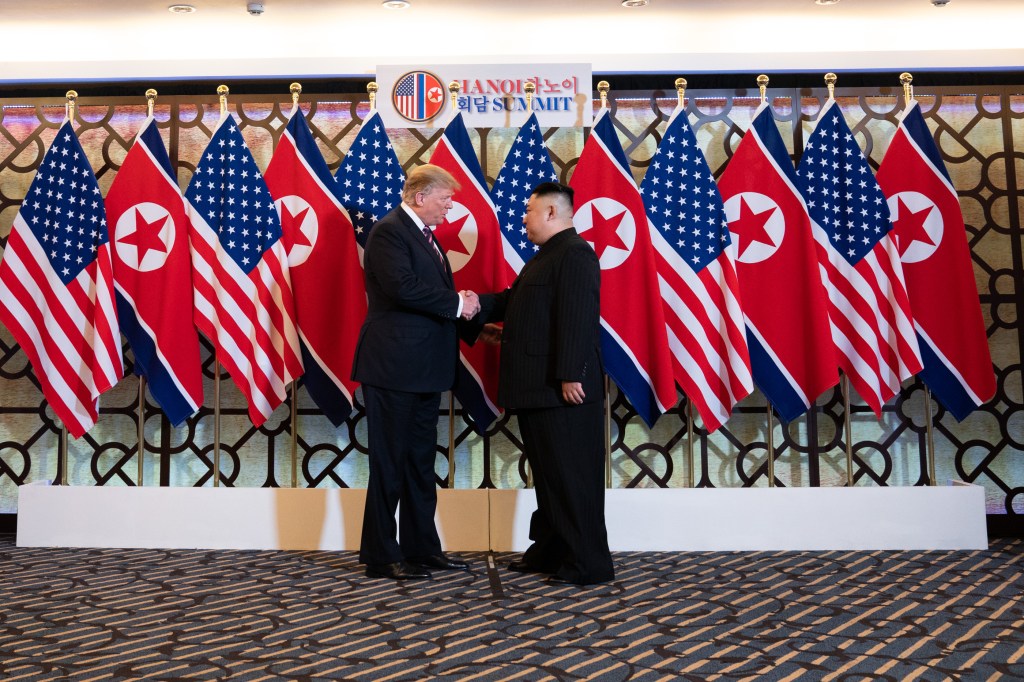

By Mary Iwase | YPFP Member | July 22, 2024 | Photo Credit: Flickr

With the November 2024 U.S. presidential election around the corner, incumbent President Joe Biden and Republican nominee, former President Donald Trump, have doubled down protectionist trade policies to appeal to the domestic electorate. The Democratic Party’s newly announced presumptive nominee, Vice President Kamala Harris, has consistently similar, if not more progressive, positions on trade to Biden. While domestically, protectionist trade policies hold strong appeal among blue-collar union conservatives, these policies will be disastrous for the United States’ relations with its allies when Washington needs allies’ support to form a bloc of like-minded countries to counter China.

The revival of American trade protectionism has raised much-expected concerns among U.S. allies and partners. It could force them to seek alternative trade alliances and markets, including those with China, potentially reshaping the global economic landscape and diminishing the U.S.’s influence in international trade.

As such, U.S. policymakers must look beyond political expediency and rhetoric and embrace strategic wisdom, understanding that protectionism will have undesirable consequences detrimental to American interests.

Stances Of Both Major Presidential Candidates

During the June 27 Presidential debate, Trump reiterated his proposal to impose a 10% tariff on all imported goods and a 60% tariff on imports from China—measures he claimed would reduce the U.S. deficit and penalize “countries that have been ripping us off for years.” This is despite the fact that such tariffs could have costs borne by the American consumer. The Peterson Institute for International Economics (PIIE) states that Trump’s proposed tariff plan could cost American middle-class households approximately $1700 annually.

While Harris has been critical of Trump’s tariffs and overall trade strategy, the Biden-Harris administration has seized on their incumbent advantage to demonstrate a commitment to protectionist policies. In May, the Biden-Harris administration announced the continuation and expansion of U.S. tariffs on China. While this expansion was not unexpected, it is characteristic of the race between both candidates to appear tough on China and attract voters by promoting U.S. manufacturing—a position both candidates should maintain if they desire to win key swing states in the American ‘Rust Belt’ such as Pennsylvania, Michigan, and Wisconsin.

Republican or Democrat—both sides are doubling down on protectionism to capture as many voters as they can from blue-collar, union, and middle-class Americans as possible.

Section 301 China Tariffs

More specifically, the May 14 announcement involves maintaining most of the Section 301 tariffs on Chinese goods, initially imposed during the Trump administration. It includes further tariff increases on $18 billion worth of Chinese imports in strategic sectors like solar energy, electric vehicles (EVs), EV batteries, critical minerals, semiconductors, and steel and aluminum. Moreover, on May 16, the administration announced the closure of existing tariff exclusions for bifacial solar panels under Section 201, with certain solar imports from Cambodia, Malaysia, Thailand, and Vietnam set to end on June 6, 2024.

| Products | Products | Tariff Rates | Implementation Year |

| EV, Batteries, Battery Components and Parts, and Critical Minerals | EV | From 25% to 100% | 2024 |

| Lithium-ion EV batteries | From 7.5% to 25% | 2024 | |

| Lithium-ion non-EV batteries | From 7.5% to 25% | 2026 | |

| Battery parts (non-lithium-ion) | From 7.5% to 25% | 2024 | |

| Natural graphite and permanent magnets | From 0% to 25% | 2026 | |

| Other critical minerals | From 0% to 25% | 2024 | |

| Solar | Solar cells | From 25% to 50% | 2024 |

| Steel and Aluminum | Steel and Aluminum | From 0-7.5% to 25% | 2024 |

| Semiconductors | Semiconductors | From 25% to 50% | 2025 |

Some of the Section 301 tariff increases (source: White House fact sheet and USITC)

Although this represents just around 4 percent of overall Chinese exports to the United States, the Tax Foundation estimates that these measures could, in the long run, reduce U.S. GDP by 0.2%. Furthermore, industry groups have highlighted the potential negative impact on US manufacturers who rely on imported components, noting that higher tariffs could disrupt supply chains and increase production costs.

No Appetite for New Trade Agreements with Allies

While industry leaders advocate for new trade agreements with allies and partners and a comprehensive and transparent Section 301 exclusion process, there is a notable lack of momentum toward forging new trade agreements with US allies. This reluctance is driven by several factors, including domestic political considerations, concerns about labor and environmental standards, and a broader shift towards economic nationalism, which resonates within both the Democratic and Republican parties. Despite Biden and Trump signaling a preference for bilateral deals over multilateral agreements, the current political climate in Washington is not conducive to bilateral trade negotiations either.

The focus on protectionism and the lack of new trade agreements may enable emerging powers to fill the gap created by the U.S. and reshape the global economic order. China, for instance, aims to finalize negotiations on version 3.0 of the China-ASEAN free trade agreement in 2024. China is also accelerating its efforts to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a successor to the agreement from which the U.S. withdrew in 2017.

The Indo-Pacific Economic Framework for Prosperity (IPEF), launched by the Biden-Harris administration in 2022, serves as an alternative to the CPTPP, showcasing what the U.S. can offer in the trade arena – an agreement without provisions for market access and tariff reduction. Despite these omissions, the USTR-led trade pillar has struggled, making no significant progress during the IPEF negotiations in Singapore last month. This stagnation is partly due to concerns over digital trade rule-making and congressional opposition to new trade initiatives in an election year.

Whichever way the election swings, the U.S. seems poised to keep its protectionist sails hoisted, navigating a complex global trade landscape with a steady, cautious hand. Expanding their engagement with the CPTPP might be the prudent path for U.S. allies and partners until the U.S. reorients toward more open trade policies.

The Way Forward

Policymakers in the United States must first understand that as appealing as protectionism sounds for the populist masses and those who desire to win over their hearts, protectionist policies cannot be implemented in a vacuum.

Most, if not every, protectionist measure will draw retaliatory moves from trading partners, who could either slap further tariffs on American goods, hurting U.S. manufacturing, or diminish trade with Washington in search of other partners.

As such, politicians must consider what is best for the next generation of Americans rather than what is best for the next election.

The first order of business thence must be to bolster bilateral trade with key allies and partners to strengthen economic ties and create mutually beneficial trade opportunities. Second, Washington should consider sector-specific multilateral trade agreements, engaging, as the name suggests, in multilateral trade agreements targeting specific sectors of strategic significance, notably semiconductor technology, energy, and critical minerals. This approach would lower the barriers for the U.S. to join multilateral agreements. Lastly, the United States should rejoin the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Rejoining the CPTPP would enhance U.S. access to fast-growing markets and strengthen economic alliances in the Asia-Pacific region while counterbalancing China’s rising influence in global trade.

Mary Iwase is a Research Analyst at the Japan Bank for International Cooperation (JBIC). She holds a Bachelor of Arts in International Affairs from George Washington University. Follow her on LinkedIn.