Eric Lin | YPFP Member | October 19, 2024 | Photo Credit: Flickr

The Electric Revolution

Transportation is the cornerstone of modern society, connecting distant regions, enabling the movement of labor and goods, and increasing business productivity. As part of Chinese President Xi Jinping’s grand vision to build the country into a strong, automaking nation and transition towards a green economy, the Chinese Communist Party (CCP) has utilized industrial policy tools to electrify and transform its transportation sector. The state action is visible throughout the sector to incentivize supply, maintain demand, and calibrate market equilibria through significant government funding and other forms of support.

China’s domestic electric revolution has moved at a rapid pace. As recently as 2009, only a handful of electric vehicles (EVs) drove on the roads in Shanghai, one of the four metropolitan cities in China. Four years later, in 2012, China created the world’s largest EV market. Eight years later, the homegrown auto company Build Your Dreams (BYD) overtook Tesla to claim the title of top-selling EV maker in the world in the last quarter of 2023.

China’s rapid market expansion in Europe, Africa, Southeast Asia, and South America has established a robust worldwide EV supply chain, overseeing the production of raw materials, batteries, charging infrastructure, and vehicle assembly. In 2022, China accounted for over 90 percent of global EV sales and over 70 percent of EV battery production. China also controls over half of the worldwide mining and processing capacity of virtually every critical mineral, including manganese, cobalt, lithium, aluminum, graphite, and nickel, which comprise an EV battery.

“Build Your Dreams” Policy 101

President Xi first introduced the concept of an “EV Dream” during an inspection of Chinese automaker SAIC Motor in 2014. One year later, the State Council issued the Made in China 2025 plan, formally outlining New Energy Vehicles (NEVs) as one of the seven Strategic Emerging Industries. China has sought to bolster this industry by targeting supply and demand in the EV market with a comprehensive set of industrial policy tools designed to create a favorable environment for domestic producers and consumers.

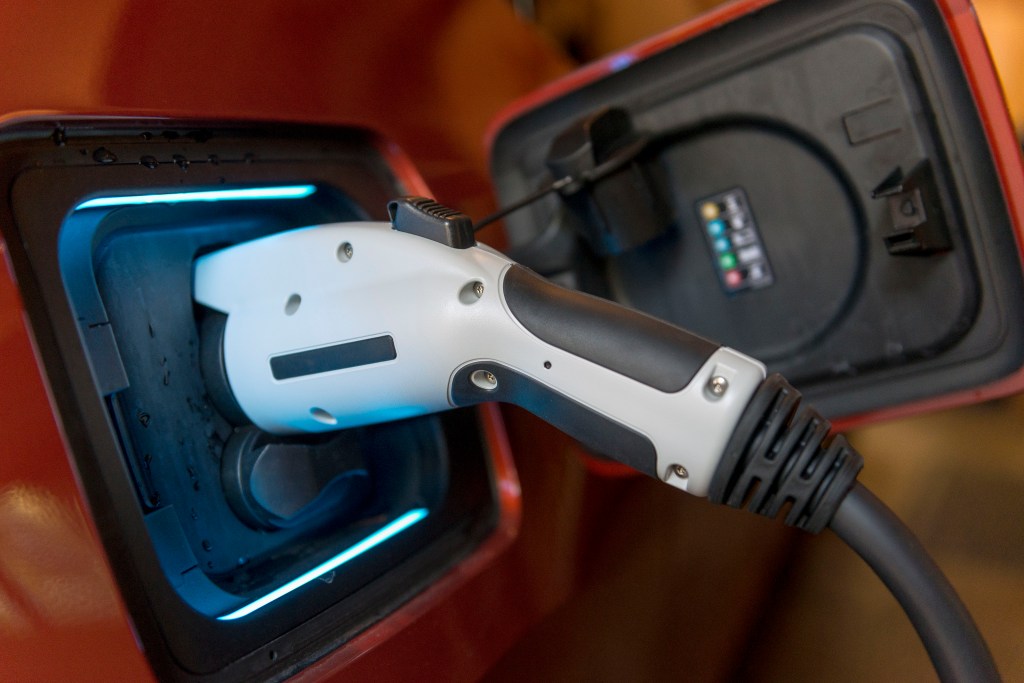

To bolster supply, China poured $230.8 billion into the entire EV supply chain between 2009 and 2023, including raw materials extraction, research and development (R&D), and the manufacturing of batteries, engines, and chassis. The state strategically subsidized domestic battery suppliers that met recovery rates for critical battery metals, raised market access obstacles for foreign battery producers through increased tariffs, forced foreign technology transfer within joint ventures, and banned high-polluting vehicles. The state has also undertaken several initiatives to generate demand, including offering rebates to consumers purchasing EVs, utilizing tax credits, requiring provincial governments to use more EVs, and mandating that charging facilities be built in new residential communities.

While market forces and state policies keep EV suppliers’ production lines running, winning over consumers has proven more challenging. China has heavily relied on its industrial policy support ecosystem to address this, directing over 75 percent of the supporting policy portfolio between 2009 and 2023 toward consumer subsidies, such as rebates and sales tax exemptions. Alongside these demand-side incentives, policies aimed at scaling up charging infrastructure have significantly alleviated consumer concerns about the inaccessibility and inconvenience of EV charging.

BYD Statecraft

China initially saw bolstering the EV industry as a way to reduce dependence on imported oil and curb its colossal greenhouse gas emissions. However, as homegrown auto companies like BYD, XPeng, and Geely make inroads into dividing global market shares with traditional Western industry giants such as General Motors, Volkswagen, and BMW, the CCP sees a larger picture for the strategic potential of its EV industry.

With global dominance in key EV supply chain segments and a significant cost advantage in producing EVs at home, electric vehicles and their value chain become another strategic policy tool for the CCP to enter foreign markets, exercise economic might through trade retaliation, and increase exports of other goods by leveraging existing trade channels.

China’s overwhelming price advantage, which comes from cheap labor, economies of scale, vertically integrated production, and, most importantly, government subsidies, has allowed it to quickly enter the European market by undercutting the incumbent car makers. Further, China’s dominance in critical minerals, essential for making EV batteries, strengthens the effectiveness of the country’s most favored policy tool, trade blocks, to either punish or counter trade-related punitive measures imposed by other countries. In October 2023, China restricted the export of graphite—a critical component used in EV batteries, fuel cells, and nuclear reactors—in response to the export ban on semiconductors imposed by the United States, Europe, and Japan.

With the Biden Administration’s Inflation Reduction Act (IRA) discouraging Chinese EV investment in the United States and the European Union’s newly imposed anti-subsidy duties on Chinese-made EVs, curbing China’s growing market in Europe, China is now pivoting away from its export-only strategy. As such, companies like BYD increasingly seek to find investment-oriented opportunities in emerging markets like Thailand, Brazil, and Hungary. These emerging market countries are interested in profiting from this cleantech revolution. As such, they are willing to help Chinese companies bypass certain restrictions to enter previously prohibited territory. For example, BYD’s potential manufacturing plant in Mexico could feasibly offer China a secret backdoor to the US market through the United States-Mexico-Canada Agreement (USMCA).

Conclusion

China has effectively shifted its resources to build an electric economy through government intervention, heavy subsidies, and firm control of critical mineral resources, making it a dominant player in the EV industry. The United States, the European Union, and other members of the international community should recognize that China will continue to utilize its BYD playbook to gain a geopolitical advantage and expand into emerging markets by leveraging its control over the supply chain. Beijing will continue to create competitive advantages for its companies through EV-oriented foreign investments and beneficial pricing strategies. The United States, the European Union, and others should identify potential monopolistic behavior exercised by Chinese auto companies in the international market and pursue measures to block such behavior to maintain a fair and competitive open market.

Eric Lin is a YPFP member and recent graduate of Bard College with a Bachelor of Arts in Economics and Mathematics, and a Bachelor of Music in Classical Viola Performance. He is a quantitative researcher by training that is also passionate about analyzing international relations, and Diversity, Equity and Inclusion initiatives.