By Mitchell Clark | YPFP Member | August 26, 2025 | Photo Credit: Flickr

China has recently accelerated the spread of its influence into Latin America via its highly controversial Belt & Road Initiative, which is an enormous global infrastructure project aimed at strengthening China’s economic cooperation with nations across the globe. Two-way trade between China and the CELAC (Community of Latin American and Caribbean States) bloc “was $515 billion in 2024, according to Chinese customs data, up from $450 billion in 2023 and just $12 billion in 2000.” This dynamic poses a significant threat to the United States’ economic foothold in the region that could redirect billions of dollars of trade away from the U.S. and towards China, and therefore weaken both U.S. export and import power. This trade redirection risk impacts energy, agricultural goods, and various other sectors. For example, Latin American coffee producers have moved rapidly toward the Chinese export market in response to U.S. tariffs. The White House should be pursuing genuine trade deals with Latin American nations rather than imposing trade barriers. The now burgeoning relationship between Latin American nations and China was once isolated to a few nations such as Brazil, Peru, and Venezuela, but now extends far past that. Additionally, public opinion in Latin American nations has shifted towards a more favorable viewpoint of China. Between February and April 2025, China’s favorability rating in Colombia has risen from 50% to 62%, far exceeding Colombians’ 40% favorability rating toward the US.

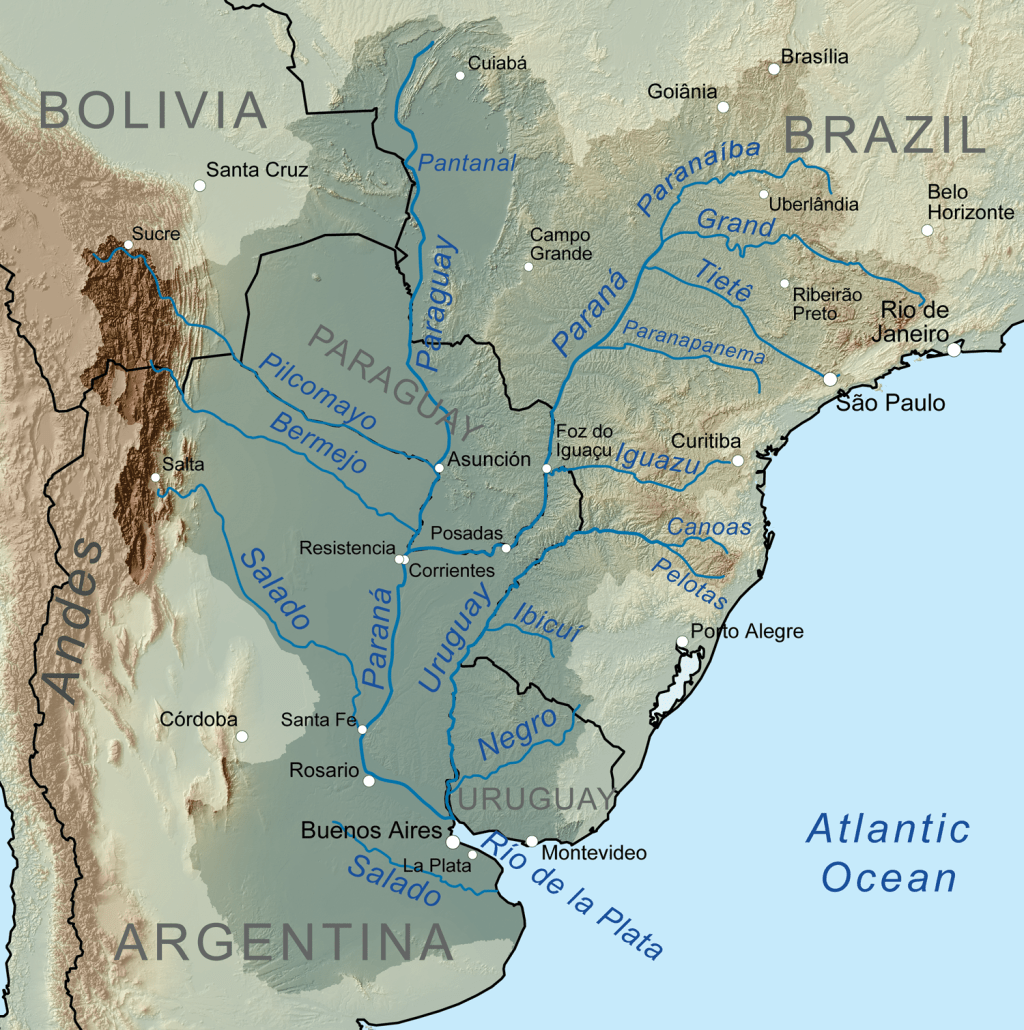

Belt & Road investments in Latin America focus on ports, railways and power plants, as well as industries including space and energy. These investments include $9.2 billion in credit financing, $20 billion in infrastructure, lending $10 billion in concessional debt, and establishing a $5 billion cooperation fund. The investments have been paired with knowledge transfer agreements, such as the China-LAC Technology Transfer Center and the China-Brazil Earth Resources Satellite program, which function as joint innovation mechanisms. China has invested over $73 billion in raw material industries, with a clear focus on lithium production in the “Lithium Triangle” nations of Bolivia, Chile and Argentina as means of supporting its electric vehicle supply chain. Beijing’s visa free entry policy for citizens from five Latin American nations is yet another measure removing bilateral relationship barriers.

Some Latin American nations prefer collaboration with China over the U.S. because they view Chinese support as less conditional, and view support from the U.S. as conditioned on terms such as the advancement of democratic measures. Additionally, some Latin American nations seek to decrease reliance on U.S. Dollar. Latin American nations partnering with China are “doing a lot more yuan-based deals, particularly for credit swap agreements making it easier for the borrowing country to transact in RMB rather than USD.” Latin American nations see this minimized reliance on the USD as beneficial by potentially reducing their transaction costs, providing quick access to Chinese financing when needed, and enabling more flexibility in trade and debt repayment with China.

Having stronger Chinese economic ties poses risks to Latin American nations, including debt traps and opaque contract terms. Bolivia and Peru provide case studies of these downsides, evidenced by low quality infrastructure and inadequate transparency. Despite these risks, countries such as Colombia and Ecuador have shown a clear desire to diversify their economic engines away from the West.

Having its largest global adversary expanding its influence on a neighboring continent puts the U.S. in a vulnerable spot economically. One research model of export competition estimates that each 1% rise in Chinese exports lower U.S. imports from Latin America by approximately 0.75%, meaning that U.S. trade competition with China in Latin America is close to a zero-sum game. Given the nature of this relationship, the imposition of tariffs, such as 50% tariffs on Brazilian products, only amplifies the trade redirection risk. Tariffs also sparked a downturn in U.S. port volume outcomes shortly after their imposition. Yet, most Latin American nations have not completely dismissed their U.S. relationships. Both the Colombian and Mexican governments have plainly expressed they do not intend to alienate the U.S.

The United States’ combative tactic of levying tariffs has incited trade retaliation and driven negative trade volume results, which should hasten U.S. willingness to employ a more conciliatory tone toward Latin American trade. To best navigate this dynamic, the White House must minimize self-inflicted trade policy wounds via tariffs that assist China’s rise in Latin America. The chance to maintain American economic superiority in Latin America isn’t lost, but time is of the essence.

Mitchell Clark is a financial analyst for Northrop Grumman and is currently enrolled as an MBA student at Carnegie Mellon University. He received his B.S. in Supply Chain and Information Systems from Penn State University-University Park.