By Azira Ahimsa | Rising Expert on Technology | October 12, 2025 | Photo Credit: Flickr

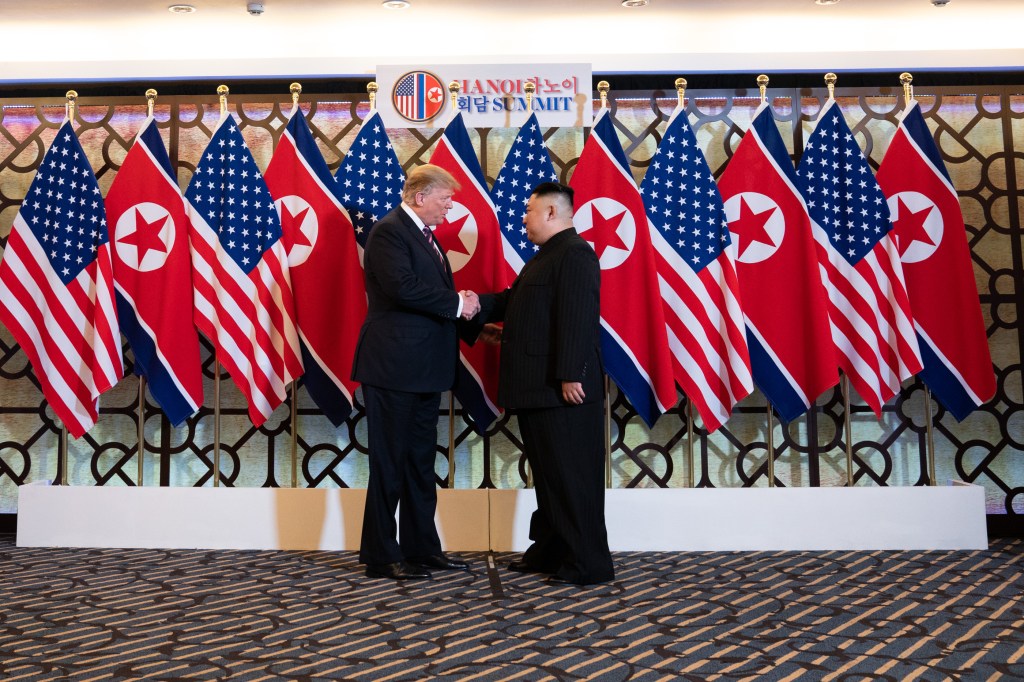

In August, as European Commission President Ursula von der Leyen toured a gleaming new fab in Dresden, she lauded the EU’s Chips Act as “the foundation of our digital sovereignty.” Half a world away, China’s semiconductor czars hoisted banners proclaiming their goal of “complete chip self-reliance” by 2027. Meanwhile, Washington’s latest export curbs on advanced lithography tools have ostensibly locked Beijing out of cutting edge chip production. Together, these moves can be interpreted as escalations in a silicon arms race. But rather than lamenting this geopolitical fragmentation of semiconductor supply chains, ‘chip nationalism’ could be a catalyst for a healthier, more resilient industry. For America and its allies, this shift could be especially advantageous: unlike China’s drive for autarky, their diversified and cooperative approach promises to make their chip supply chains both more resilient and strategically aligned.

For decades, the semiconductor industry consolidated around the freakishly efficient ‘Big 3’ mega-fabs – Taiwan’s TSMC, South Korea’s Samsung, America’s Intel – and a handful of electronic design automation (EDA) tool vendors. That concentration delivered spectacular economies of scale but at the cost of systemic fragility: a single earthquake, fire or pandemic-induced border closure could ripple through every corner of the tech ecosystem. Now, export controls and national subsidies are forcing governments and their corporate champions to cultivate mini-ecosystems. Out of necessity, dozens of smaller ‘edge fabs’ and boutique foundries are sprouting across Europe, the United States, India and Southeast Asia. Startups that once outsourced production to the Big 3 are rediscovering the art of hardware co-design at the wafer level, forging tighter feedback loops between chip designers and manufacturing engineers. The result? Chips built for specific markets – automotive, healthcare, 5G/telecom – rather than generic all-purpose nodes.

Decentralization undoubtedly carries risks: subscale fabs are significantly more expensive, sometimes costing 30-50% more per transistor than industry leaders like TSMC or Samsung, because they cannot spread research and development (R&D) and equipment costs across as much output. Beyond operating costs, the upfront capital required is staggering – an advanced fab can cost $10-$20 billion, a scale of investment only a handful of industry players such as those in the United States, Taiwan, and South Korea can realistically sustain. For most countries, attempting to build local end-to-end capabilities would be unrealistic. Instead, they may find value in specializing in parts of the supply chain – as Malaysia already does with packaging and testing, or as the Netherlands does with lithography equipment.

Still, smaller fabs can unlock new forms of innovation, particularly in domain-specific chips. For example, Israeli startups have pioneered specialized artificial intelligence (AI) processors for cybersecurity, while European firms are tailoring microcontrollers for next-generation automotive systems. Imagine a Mediterranean consortium building chips optimized to process LiDAR data – laser-based sensors used in autonomous cars – in real time, or a Nordic cluster developing ultra-low-power AI accelerators designed specifically for renewable energy grids. These chips will not be as general as TSMC’s cutting-edge all-purpose processors, but they could serve strategic niches where performance and local adaptation matter more than scale.

That distinction is crucial: smaller fabs cannot replace a giant like TSMC in supplying the world’s most advanced logic chips, but they can complement it by producing less advanced nodes or highly specialized designs. Their role in ‘picking up the slack’ is therefore limited to certain market segments – but that still provides valuable resilience if one part of the global system falters. Policymakers must therefore resist the illusion that every country can – or should – replicate TSMC. Viewed this way, chip sovereignty is best seen as a resilience strategy: dispersing capacity and diversifying functions to guard against geopolitical and climatic risks.

Policymakers should seize this moment to cement the benefits. First, they can encourage the creation of more flexible, ‘open’ chip factories – plants that are compatible with different design software and a wider range of customers, instead of locking firms into one proprietary system. Think of it as the hardware equivalent of open-source software: lowering barriers for smaller chip startups, making it easier for them to generate prototypes, and encouraging cross-border collaboration on common standards.

Second, governments and firms should work toward a system of “collective chip security” built on specialization. Instead of trying to duplicate every step of production, allied nations could invest in complementary strengths. At present, most restrictions – such as U.S. and Dutch bans on advanced lithography equipment sales – target strategic competitors like China, not allies. But even among partners, sudden disruptions can occur if supply chains are too concentrated. Formalizing ‘resilience agreements’ will be a helpful approach – where different countries specializing in particular parts of the supply chain – lithography in the Netherlands, packaging and testing in Malaysia, advanced design in the U.S. and India, automotive chips in Europe – ensure reciprocal access in times of crisis. This would turn today’s fragmented supply chains into a coordinated network that provides the U.S., Western economies, and allied countries with a stronger buffer against shocks.

The era of just-in-time global chipmaking is drawing to a close. But its successor – the era of just-right-here microelectronics – promises to be more dynamic, more secure and ultimately more inventive. Instead of mourning a bygone age of consolidation, we should hail chip nationalism as the vital shake-up that breaks concentrated monopolies, ignites grassroots innovation clusters, and ushers in a genuinely multipolar silicon order. In the looming Cold War of the microchip, diversity may prove to be the strongest weapon.

Azira Ahimsa is the 2025 YPFP Rising Expert on Technology. She previously worked as part of the Indonesian Critical and Enabling Technology Team at the Australian Trade and Investment Commission (Austrade), supporting Australia’s tech engagement in Indonesia. She also previously served as Senior Trade and Investment Manager for Digital Trade at the UK Department for Business and Trade, where she led the UK’s first AI Mission to Indonesia. With a background in defense studies and commerce, Azira has also co-founded a UK-based impact investing platform and worked in aviation consulting in Denmark. An alumna of Durham University and the University of Western Australia, she enjoys fencing, writing non-fiction, and exploring new places.