By Anjali Bhatt | Rising Expert on Economics | March 1, 2024 | Photo Credit: Flickr

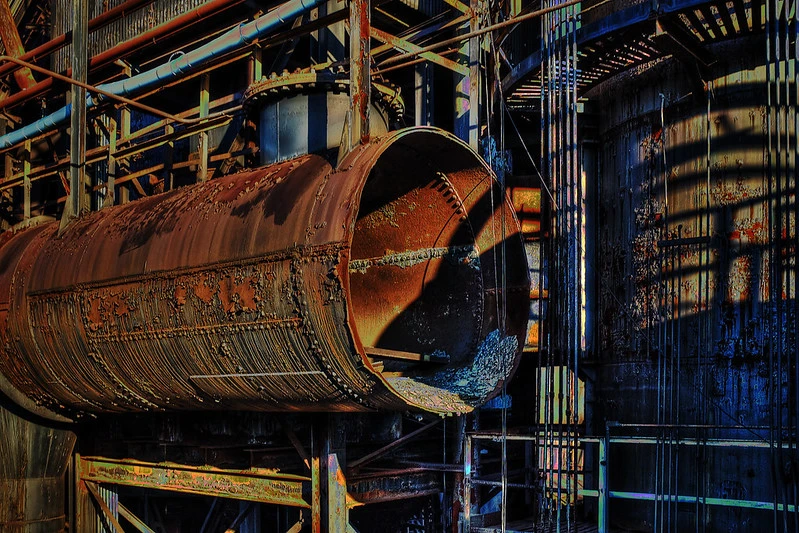

Nippon Steel Corporation, Japan’s largest steel company, is buying United States Steel Corporation (US Steel), the third largest steel company in the United States. Once the most valuable company in the world, supplying steel to power much of America’s industrial growth in the 20th century, US Steel’s decline has been decades in the making. Driven by cheaper Chinese steel flooding world markets, coupled with lagging uptake of more efficient steelmaking processes, US Steel had been searching for a buyer since the summer of 2023.

Since its announcement, the deal has received backlash from both sides of the aisle in Congress and the White House, indicating a long uphill battle. The crux of the opposition’s argument is that Nippon’s takeover of US Steel threatens US national security. This politically motivated argument—which alleges that any foreign ownership of a company that has any role in US defense manufacturing or infrastructure supply chains is a threat to supply chain integrity and economic security, as well as steel jobs—does not stand up to scrutiny, given Japan is a close ally and it just so happens to be an election year. Given the emphasis on traditional industries like steel in political messaging as representative of “good jobs” and enduring appeal of national security, the issue has already risen to national controversy. However, there may be a way for President Biden to assuage these unfounded national security concerns without offending a close ally, while making clear that the United States welcomes foreign investment.

Democratic policymakers, including Senators Bob Casey (D-PA) and John Fetterman (D-PA), and Representative Chris Deluzio (D-PA-17), claim the acquisition would be “a step backwards in our commitment to supply chain integrity and economic security.” Republican Senators Josh Hawley (R-MO), J.D. Vance (R-OH), and Marco Rubio (R-FL), argue the deal “raises national security concerns and threatens to weaken America’s industrial base.” Congressmen from both parties are calling on Secretary of the Treasury Janet Yellen to block the deal.

Yellen is the chair of the Committee on Foreign Investment in the US (CFIUS), an opaque multi-agency entity that reviews foreign investment into the United States for national security threats (it’s also the body involved in the slow-moving TikTok fiasco). CFIUS’ “risk-based assessment” investigations are classified, aiming to insulate itself from political winds as it handles matters of both national security and confidential information from the private companies it reviews. Nippon has already indicated it will voluntarily submit an application to be reviewed by CFIUS. In fact, it’s written into the Merger Agreement filed by US Steel and Nippon to the Security and Exchange Commission that the sale is conditional on “the receipt of approval” by CFIUS. Based on CFIUS review, Secretary Yellen can advise President Biden on whether to approve or reject the deal—or impose conditions upon it.Rejecting this deal would be costly to the US-Japan relationship, a relationship that is critical to the larger US strategy of working with allies and partners to compete with China.

Washington has been working closely with Tokyo on a number of issues, including coordinating export controls on advanced semiconductors to China, on regional diplomacy through the Quad grouping (with India and Australia), and on trade and economic engagement through the Indo-Pacific Economic Framework (IPEF). Given the range and depth of this bilateral cooperation, turning around and snubbing one of its ally’s largest companies on the basis of national security threats would be disastrous, and at its core, hypocritical. Japan would rightly see the failing of this deal as the Biden administration caving to domestic political pressures, and question US commitment to the other initiatives on which they are working with Washington. It would also signal to other US allies that CFIUS’ definition of national security is broadening, eroding trust in the US investment environment and prompting potential retaliation against US investment abroad.

Critics of the deal erroneously argue that if it goes through, Nippon could interfere in the US steel market, constituting a national security threat. Nippon is purchasing US Steel for the same reason any company makes decisions: to make money. Nippon expects an “uptick” in demand for steel in the United States spurred by the 2021 Infrastructure Bill. The domestic content requirements for those infrastructure projects require steel to be produced in the United States—all but guaranteeing continued domestic steel production and employment, including with the advanced steel-making technology Nippon can bring to US mills. The president and executive vice president of Nippon explained as much in the Wall Street Journal.

It also seems unlikely that Nippon would meddle in sales of steel to the US military—Japan acquires more than 90 percent of its defense imports from the United States. Furthermore, the US Department of Defense (DOD) requires around 3 percent of US steel production for its military needs. US Steel is only responsible for roughly 18 percent of US steel production. In the highly unlikely scenario Nippon refuses to sell steel to the DOD, other players in the US market have the capacity to meet that demand.

It’s no coincidence that several Congressmen who wrote to Secretary Yellen are from electorally vulnerable Rust Belt states—Pennsylvania and Ohio. The Pennsylvania Congressmen, hailing from where US Steel is headquartered and will remain, cite Section 232 tariffs on steel and aluminum imports as proof that steel from Japan is a national security threat. Started under President Trump in 2018 and continued by President Biden, tariffs are essentially a tax on imported steel, even from close allies, under the dubious basis that imported steel threatens national security and that the domestic steel industry needs protecting. The cost to steel-using industries was an extra $650,000 per every job “saved” in the domestic steel industry. What these lawmakers fail to acknowledge is a subsequent 2022 tariff agreement “addressing a major irritant between the United States and Japan, one of our most important allies” that allowed Japanese steel to be imported to the United States duty-free. The agreement does not lift the tariffs and instead mandates a quota of Japanese steel imports, amounting to managed trade rather than free market transactions, but national security was not even mentioned in the announcement.

The CFIUS review will take several months, entirely under wraps. The companies project the deal to be completed by the second or third quarter of 2024, though reports of a longer timeline recently arose. Blocking or allowing the deal would both be politically controversial domestically and internationally, but the nature of the CFIUS review presents a third option: imposing conditions on the acquisition. President Biden could allow Nippon to purchase US Steel conditional upon, for example, maintaining certain levels of production or employment in the United States, or carving out a US-owned subsidiary that would handle defense-related production.

Making Nippon’s purchase of US Steel conditional on measures to mitigate supposed national security threats may be the best option for President Biden to balance the competing interests vested in the deal. Even so, CFIUS may draw out its review past the 2024 election, rendering electoral considerations moot. Nippon and US Steel can only wait and see.

Anjali Bhatt was the 2023 Rising Expert on Economics. She is currently the Social Media and Digital Communications Manager at the Peterson Institute for International Economics. She is also pursuing an MA in International Affairs at the University of California, San Diego.