By Mary Iwase | April 13, 2024 | Photo Credit: Freeimages

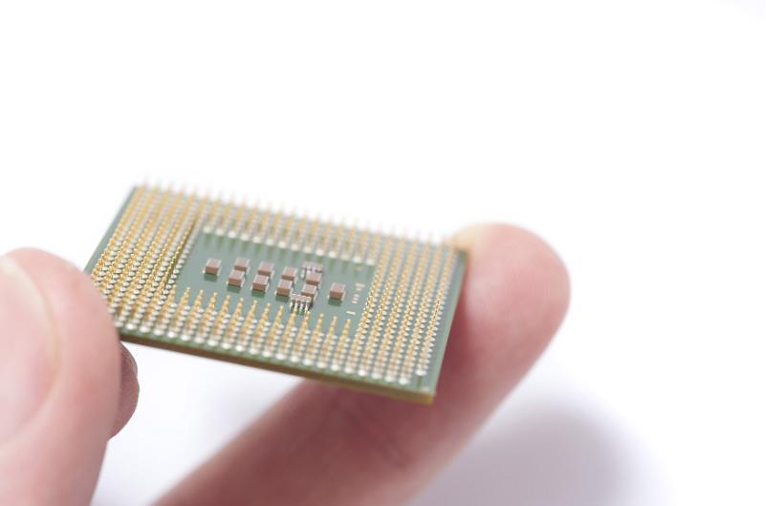

Semiconductors are the unsung heroes of the digital age. These tiny titans—most often referred to as microchips—power our smartphones, computers, and even spacecraft. While chips have a pervasive impact on our daily lives, they have also shaped the geopolitical landscape for years. Today, the United States is engaged in a global semiconductor race against China, trying to develop and secure the most advanced semiconductor technology. However, it’s not so much a solitary sprint as it is a relay race where cooperation with allies and partners is crucial to victory.

State of Play on Semiconductors

When the U.S. Congress passed the CHIPS and Science Act of 2022, it allocated, among many other things, $280 billion towards advancing cutting-edge technologies. This landmark legislation signaled an official effort to restore U.S. domestic capacity for microchip development and production and, together with allies and partners, to get ahead in the ongoing technological competition with China. Following the passage of the CHIPS Act, prominent industry players, including Texas Instruments, Intel, Micron in the United States, and Samsung Electronics in South Korea, unveiled plans to establish their own state-of-the-art semiconductor facilities within U.S. borders. At the same time, Taiwan Semiconductor Manufacturing Company (TSMC) commenced construction on an advanced semiconductor facility in Arizona. In another notable development, on April 8, 2024, TSMC secured a $6.6 billion funding award and announced plans to build an additional factory in Arizona. (Samsung will reportedly receive another grant too).

A crucial component of the legislation that is intended to strengthen collaboration with allies and partners establishes the International Technology Security and Innovation (ITSI) Fund. This fund, which allocates the State Department $500 million over the next five years (beginning in FY23), aims to ensure the security and diversification of the U.S. semiconductor supply chain. The Department of State has identified a set of critical partners in Southeast Asia and Latin America in this effort, including Costa Rica, Panama, Vietnam, Indonesia, the Philippines, and Mexico. The Biden administration’s flagship multilateral frameworks, such as the Indo-Pacific Economic Framework for Prosperity (IPEF) and the Americas Partnership for Economic Prosperity (APEP), further bolster these partnerships and prioritize supply chain coordination with a focus on the semiconductor industry.

The United States is also engaging with allies and partners to reinforce export controls on advanced semiconductor technologies to China. This measure, born out of the Trump Administration’s tech war in 2018, is aimed at curbing China’s access to cutting-edge technologies that fuel its military modernization efforts. Following the initial announcement of export control measures (the ‘October 7 controls’), the U.S. Department of Commerce urged allies such as Japan and the Netherlands to adopt similar measures, mainly due to the presence of advanced manufacturing equipment makers in these countries that export to China. Recent reports indicate that the United States pressed Japan, the Netherlands, Germany, and South Korea to strengthen existing controls and to identify and close potential loopholes.

Challenges with Cooperation

Collaboration in the global semiconductor race with allies is vital to countering Chinese influence and dual-use technological progress, safeguarding intellectual property, and managing risk. The complexity and scale of semiconductor defense against China requires collective action, as no single nation, including the United States, has all the necessary resources, expertise, and capacity to establish dominance in this race.

Two main challenges hinder collaboration with allies and partners today.

- The provision in the CHIPS Act related to “national security guardrails,” which prohibits funding recipients from engaging in “significant transactions” with China for ten years from the award date, is giving some allies pause. Korean and Japanese companies, particularly those with established business operations in China, expressed concerns over this clause. It is evidently a significant barrier to their participation in CHIPS incentive programs and investment in the United States. The October 7 controls further highlighted this dilemma when allies and partners were forced to align with either the United States or China, but many remained hesitant to assume a publicly confrontational stance due to deeply entrenched economic ties with China.

- U.S. politics is creating uncertainty. Former President Trump’s statements indicating the potential cancellation of initiatives like the Indo-Pacific Economic Framework for Prosperity have generated significant concerns among member nations. Also, House Republicans recently blocked the inclusion of the bid to expedite semiconductor production (known as permitting reform) in the FY24 National Defense Authorization Act. This move could lead to significant delays in projects funded under the CHIPS Act. Given that 2024 is an election year, and political polarization is at an all-time high, allies are understandably harboring doubts about the direction of semiconductor manufacturing in the United States, and wondering where the next administration may sit on supply chain coordination with allies in the future.

Navigating these challenges is critical for sustaining cooperation in the global semiconductor race over the long term. The Biden administration and future policymakers should be mindful of and not discount allied uncertainties; instead, they should strive to develop approaches in the tech competition that explicitly align U.S. and allied interests. Because ultimately, in the intricate circuitry of geopolitics, the power of cooperation isn’t just a component—it’s the very chip that powers progress.

Mary Iwase is a Research Analyst at the Japan Bank for International Cooperation (JBIC). She holds a Bachelor of Arts in International Affairs from George Washington University. Follow her on LinkedIn.